According to German law, if you are an international student from a non-EU or non-EEA country, you must prove that you have the financial resources (Finanzierungsnachweis) to cover your living expenses and in order to study in Germany.

One needs to have a blocked account opened to secure a German visa. Despite at first seeming overwhelming, the necessities are reasonable, and although it may seem overwhelming, you will see that it is for your benefit.

What is a Blocked Account?

Blocked account in Germany is mainly for non-European students who wish to study bachelor’s, master’s, or language course in Germany.

In order to further your studies in Germany, you must demonstrate that you are financially stable. There are three types of bank accounts in Germany:

- Current Account (Girokonto)

- Savings Account (Sparkonto)

- Blocked Account (Sperkonto)

Once you receive a letter of acceptance from your university, then you must open a blocked account. It is one of the simplest ways to prove financial stability during your German visa interview. At least during the first year of your study in Germany, you must be able to prove your financial independence. A blocked account can also be opened in your country.

Germany Blocked Account Amount for 2022

As per the policies of January 1, 2021, the amount required to be credited to a blocked account when applying for a student visa to Germany is € 10,332 or € 861 per month.

Keeping this value in the blocked account is a requirement for proving your financial capacity (Finanzierungsnachweis) to obtain a student visa. If you deposit more than that, you can withdraw that extra amount at any time. Once the limit is exceeded, a student cannot withdraw more than 861 euros per month.

Blocked Account Providers in Germany

Several companies offer blocked accounts, so it’s hard to choose which is best. The following are some of the most popular blocked account providers in Germany:

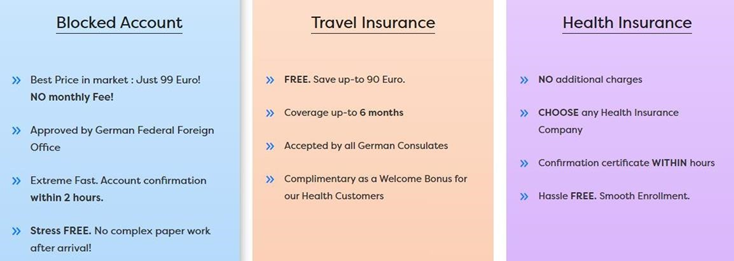

- Coracle – Your blocked account is open within 24 hours. You will get a Blocking. Confirmation in about one week or as long as it takes for the money to transfer. You can get a joint package with health insurance. Open Your Account Easily at https://www.coracle.de/blocked-account/application

- Expatrio – There are several benefits to using Expatrio. Let’s start by looking at the fees.

– Account Opening fee – €49 (reimbursed if you opt for Value Package) – Monthly fee – €5

– Account Opening time – 0 -1 business day (many instant openings)

An all-inclusive offer that includes a Blocked Account, Health Insurance, and other services. The package is designed to make it easy for students to obtain student visas and live stress-free lives in Germany.

- Fintiba – It’s a officially approved by the German Federal Foreign Office & accepted worldwide. Blocked Account opening in your own name to guarantee security and facilitate international money transfers. They’ve made proving your financial resources for your visa application as easy as it gets. By offering a fully digital process, they accelerate your way to Germany.

- Deutsche Bank – It is a German national bank, so it will be accepted by the Embassy. Along with the blocked account, you will also get a normal checking account automatically. The current account is where your money will be transferred monthly. There are Deutsche Bank offices nearly everywhere in Germany, so it is easier to resolve a problem if it pops up.

The various conditions that play a key role in the selection process are as follows: acceptance, security, payments, process, usability, support, and additional services.

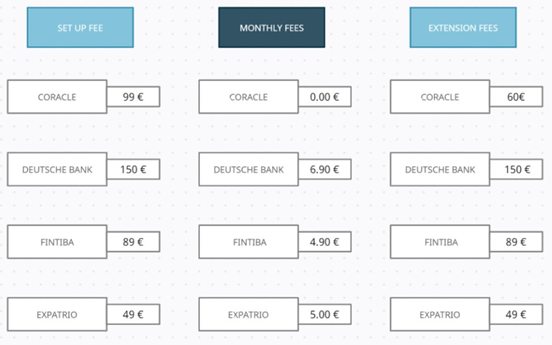

Fees for Blocked Account

The fee structures of the available blocked account services vary a little.

Low prices are not always indicative of good value for money, as other crucial factors may be overlooked. It is occasionally wise to invest a little more and thus in better quality when there is so much money on the line.

Health Insurance

All blocked account providers, except Deutsche Bank, offer health insurance packages because it is imperative to have enough health insurance coverage and financial documentation to be granted a study/language visa.

You must provide health insurance, but there are several significant differences that you should be aware of. There are two different sorts of insurance: the health insurance you must show upon entering Germany and the insurance you need while you’re there.

Furthermore, if you participate in preparatory programs like Studienkolleg or language training before beginning your studies, private health insurance is necessary.

Coracle has emerged as one of the best providers of health insurance. The salient features are:

- NO additional charges

- CHOOSE any Health Insurance Company

- Confirmation certificate WITHIN hours

- Hassle FREE Smooth Enrollment

We advise getting the insurance and a blocked account at the same time so you can save both money and time because all of the paperwork is delivered before you get to Germany and you will have less to worry about when you arrive.

Additional Services

The majority of service providers don’t just offer health insurance and blocked accounts. They provide you with a wide choice of extra beneficial services about your visa and everyday life in Germany.

- Beginning with general advice on working and living through,

- offers for learning German,

- housing services and supplementary insurance.

When selecting the best provider of blocked accounts for you, there are numerous aspects to take into account. Security is the most crucial factor whenever such a significant sum of money is at stake. Additionally, convenient processing greatly facilitates the entire procedure. Ensure that you –

- can swiftly complete the required tasks,

- have constant transparent access to your data, and

- have access to the relevant information when choosing a provider.

Coracle makes this possible by giving its users an app that allows them to get push alerts anytime they have to proceed to the next step. An integrated health insurance offer streamlines the procedure even more. It is advisable choosing an option that includes both health insurance and a blocked account because you can save money and take care of two necessities for your stay at once.

Does Germany allow students to study without a Blocked Account?

Germany allows students to study without a blocked account if they can prove they have sufficient funds by providing:

- Commitment Letter (Verpflichtungserklärung): A permanent resident of Germany (a relative or a friend) can guarantee complete coverage of your expenses during your studies.

- An income and financial status report of your parents.

- The guarantee of a bank.

- Certificate of Scholarship from a recognized scholarship provider.

What is the process of opening a Blocked Account in Germany?

Follow these steps to open a blocked account:

- Selection of the provider

- Online application for blocked account

- Fill out a printed application form if applying via the Deutsche bank

- For Deutsche Bank customers, legalization should be obtained from the German Embassy.

- Deposit funds.

- Get your blocking confirmation.

What are the documents that are necessary for opening a German blocked account?

The necessary documents may differ depending upon your nationality and the bank provider that you choose. For instance:

- ID card/passport

- Application form

- Passport

- Letter of acceptance from your university

- Bank statement of your income

- Pre-payment of fee